Originally posted on 11Jan10 to IBM Developerworks where it got 7,683 Views

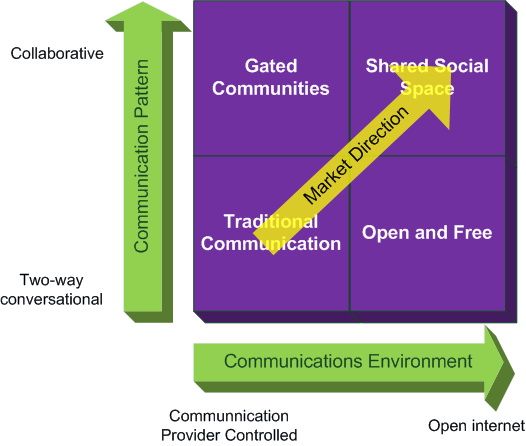

There are a number of opportunities as I see them for Telcos over the next few years. There are definite opportunities for social networking which will enable a carrier to move from a traditional communication model with their subscribers to a more collaborative and open ‘Shared Social Space’ . For mobile operators, this market movement presents both opportunities and risks for the telco making that journey.

Opportunities

- Extension of Social Networking to the mobile where operators continue to enjoy exclusivity

- Extend enterprise offerings to include Social Networking and collaborative services

- Offer users of mobile, online, and possibly IPTV, a unified rich Social network-experience across the “3 screens”

Risks

- Virtual mobile social networking operators reducing network owners to bit-pipe

One of the most obvious moves for a mobile carrier is to simply allow mobile access to social networking tools. While this might satisfy the subscribers who want mobile access to Facebook, LinkedIn, MySpace etc they are effectively reducing themselves to a bit-pipe (all of those companies already have mobile interfaces for their platform). If Telcos are going to be able to effectively fight off those Internet based rivals, the Telco MUST offer some value beyond just the pipe. That’s where the Telcos have to use their closeness and brand to the best advantage to ensure that the carriers do not get relegated to the ‘plumbing’.

I spoke about the advantages that Telcos have over the Internet based Social Networking providers, this is where the Telco must play their hand and use those advantages because failure to do so will result in them being just providers of bandwidth. One way for Telcos to exert more ownership and maintain their value for subscribers is through User Generated Content (UCG). I’ve spoken to a number of Telcos int he past year about UCG in Australia, Malaysia and Thailand – for some reason those that I spoke to all had the idea that it is a space they ‘should’ move into, yet not one of them actually had the guts to step up and do it.

This is contrary to the they I think they should be moving and it feels to me like they are stuck in an old telco product thought mode. The whole idea behind long tail applications is that you have very short time to market for your products and try out as many as you can. Kill off the ones that fail and keep and extend/enhance the ones that do well. I speak to Telcos a lot about long tail applications – usually with respect to technology like IBM Mashup Center, WebSphere sMash and Telecom Web Services Server, but also with respect to traditional SOA as well. For example, Globe Telecom in the Philippines are executing a long tail strategy for new products brilliantly – with the help of a SDP and Unified Service Creation environment based on IBM’s software, they are able to bring new products to market in as little as 15 days. It used to take them at least eight months! They know that some products will work and some will fail, but by taking advantage of the short time to market, they can launch many products very quickly. This strategy is proving very successful for Globe, their resellers and their subscribers.

Sorry – got on a bit of a tangent there… back to UGC.

A Telco that deploys a User Generate Content framework has a number of opportunities for revenue – some better advised than others. For instance, one carrier I spoke with last year wanted to charge artists/publishers to upload content. To me, that would be a good way to prevent their platform from every taking off. The table below shows the various revenue opportunities from the artists/publishes, the consumers, the advertisers and others.

Artist / Publisher

Uploads:

- Mobile:

- Free apart from Data Charges ($)

- Web:Free

- Viewing:

- Mobile:Free apart from Data Charges ($)

- Web:Free

- Consumer Purchases:

- Ringtones/RBT’s ($)

- Own Ringtone/RBT ($)

- Ringtones ($)

- Artist Wallpaper ($)

- Video ($)

- MP3 ($)

- Premium Subscriptions: ($)

- Automated alerts e.g. fan club started, x number of downloads made, etc

Subscriber

Consumer Viewing:

- Mobile:

- Free apart from Data Charges ($)

- Web:

- Free

Consumer Purchases (any channel):

- Ringtones/RBT’s ($)

- Ringtomes ($)

- Artist Wallpaper ($)

- Video ($)

- MP3 ($)

Premium Subscriptions: ($)

- Automated alerts e.g. Photo tagged

Advertisers

Broadcast Ad Revenue

- Ad inserts before video starts ($)

- Ad inserts could vary by site the video is published to e.g. Youth brand, Facebook, YouTube, etc

- Ad Funded Content

- Advertiser decides to do a “Powered by …” sponsorship for a given artist via their Fan Club for a week. ($)

Variability:

- Different ad pricing by site published to ($)

- Different pricing by artist popularity ($)

Endorsements:

- Voted #1 by Telco XYZ Social Community

- Community Testing ($)

- Selling the value of the community to relevant companies that want to test new products/ideas within the community.

Supplemental

- Cross Selling / Up Selling to Artists and Consumers

- Transactional service revenue from enabling 3rd parties to consume and use the common web services exposed from the UGC platform.

- Synthetic Currency – encourage the community members to do some rewarding. To do this they’ll need to purchase synthetic currency from the carrier.

As you can see, there are plenty of opportunities to establish new revenue streams from UCG – but any telco looking to move into this area need to tread a careful line between getting revenue and encouraging usage.